None of the three approaches is entirely satisfying. have managed to estimate the shares of top income earners in the total, often on a yearly basis, for a wide selection of countries. By adapting Kuznets’s (1953) methodology, Piketty et al. Piketty and collaborators have developed a third approach, based on tax records ( Piketty 2001 Atkinson, Piketty and Saez, 2011). This new method is less appealing for the 19th and 20th centuries, when higher-quality data are available. Milanovic, Lindert and Williamson (2011) and Lindert and Williamson (2011) have applied this approach to pre-industrial epochs. Reactions have not always been enthusiastic, as clearly shown in Feinstein (1988).Ī second thread in the literature has explored the use of the “social tables”: tabulations ranking various social groups from the richest to the poorest with their estimated population shares and average incomes. The common denominator of these studies is the use of proxies for living standards, ranging from so-called “occupational pay ratios” to the Window Tax collected under the inhabited house duty in Britain.

Limiting our attention to monetary indicators, three main strands of research have emerged in the literature.Ī first generation of studies used eclectic sources and ingenious methods: Soltow (1968), Williamson and Lindert (1980) and Williamson (1985), for example. Scholars have not been discouraged by the scarcity of suitable data, however. The most important obstacle to the advancement of our knowledge of long-run trends remains the lack of adequate historical data.

Harvard University and University of Wisconsin

#HOUSEHOLD BUDGET DEFINITION SERIES#

A dedicated working paper series promotes the dissemination of on-going research. Without imposing top-down direction, the HHB project provides a degree of coordination and direction to the collective effort of this network. The HHBD, along with an extensive collection of references is made available to scholars around the world.Ī complementary initiative is the creation of a network of researchers who provide and share data, further develop techniques for working with household budgets not collected in the context of modern probabilistic surveys, and undertake substantive research into the history of poverty and inequality. 500 variables including consumption, income and wealth, wages and retail prices, education and health, anthropometrics and fertility, employment and migration, housing, agriculture, access to credit, and exposure to shocks. The Historical Household Budgets Database (HHBD) comprises ca. The initial focus of the HHB project is the construction of a multi-topic database of household budgets from 1800 to the present day, together with associated measures of living standards. A hitherto underutilized source of data, household budgets, can provide the foundation for better estimates of long-run changes in income distribution. Existing accounts perch on a narrow evidentiary base: few countries, few indicators (often proxies), short time frames, poor comparability across sources and countries, unrepresentative groups such as the top 1 percent. If you freelance, or run your own business, your income might be too irregular for such a hard and fast rule.The aim of the Historical Household Budgets (HHB) project is to rewrite the history of both inequality and poverty over the last two centuries, and to make that history international.

#HOUSEHOLD BUDGET DEFINITION FULL#

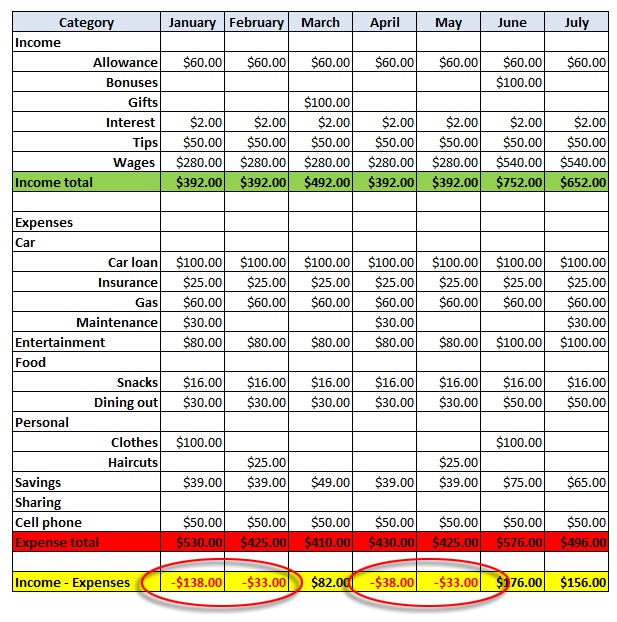

For example, people living in cities like New York or San Francisco, may need to spend almost their full paycheck on rent. The fact is when it comes to expenses one size doesn’t fit all. While it might be easy to remember, the rule isn’t always easy to live by. If the 50-20-30 budget doesn’t fit your lifestyle, try one of these instead. The 50-20-30 rule is a money management technique that divides your paycheck into three categories: 50% for the essentials, 20% for savings and 30% for everything else.ĥ0% for essentials: Rent and other housing costs, groceries, gas, etc.Ģ0% for savings: Savings accounts, retirement contributions, loans, credit card payments, etc.ģ0% for everything else: Nonessential expenses like clothing, restaurants, monthly streaming subscriptions, gyms, etc.

0 kommentar(er)

0 kommentar(er)